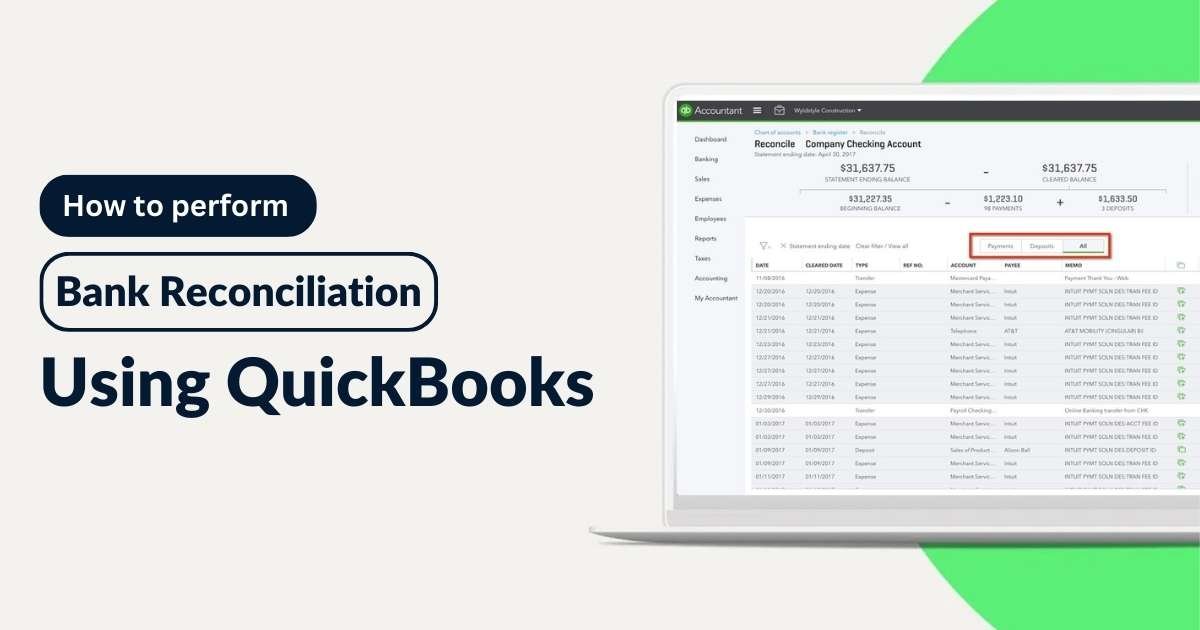

How Can You Perform Bank Reconciliation Using Quickbooks?

Bank reconciliation is one of the most important tasks that you need to perform when it comes to managing your finances. It is a process where an accountant has to compare a person’s transactions with those that they have made through their bank accounts.

The main importance of this process lies in the fact that accountants need to keep information about all important financial transactions that a person has made and not miss any detail that might be crucial. This is helpful for any accountant to know how much tax one owes to the government and whether all of their transactions are even legal or not. This is where quickbooks become important.

Quickbooks are software that help to make accounting operations automated by handling large chunks of data using AI-driven systems. These can help to create financial records based on whatever information you enter about your finances within an instant. So let us learn how these software can be used for bank reconciliation processes.

Steps to Use Quickbooks For Bank Reconciliation

The steps to use a quickbook software for bank reconciliation are as follows:

1. Enter Your Bank Balance

First of all, you have to enter your bank account details and the amount of money present in the accounts that you have in a quickbook software. This is important especially for those who are very new to such systems.

2. Enter All Transactions

You have to enter the information about all transactions you have made on your quickbooks ledger. You can always save such information on the software and update them later with more transaction statements if needed.

3. Start Reconciling

If you have entered all the transaction information for the year, then you can select the Reconcile button from the Banking menu. The Reconciling buttons and options might differ heavily based on the kind of software you are using. But the overall process remains the same.

4. Enter Credit Card Details

You might need to enter the details of the credit card that you use for the reconciliation process. You must make sure that the card is of the same bank whose balance and statement information you have entered into the software.

5. Set the Time for Checking the Information

You must update the time for information checking on the quickbooks software. This is important since most of these systems tend to set timing limits by default. So you must set your own time limits which can range from a few months to even a year.

6. Review All The Information

You must check whether you have entered all the information on the quickbook software correctly or not. If everything is correct, then you can simply press on the OK button. Otherwise, you might need to reset or make corrections to the given information.

7. Match the Transactions

After the software displays information about all the transactions you have made, you should compare them with those on your bank statements. It can be possible that some details might not be present on your bank’s statements. So you should consider changing or modifying and correcting information if necessary.

A Final Word

If you are a small business owner, then it is not necessary for you to know everything about bank reconciliation and quickbooks from the start. In fact, you might not know about such things at all. Therefore, it is always a safer option to visit or hire an accountant in order to help yourself in managing your transactions by using such software.

Choosing some of the best professional QuickBooks services for small businesses in your area can help you to get hold of people with enough expertise in using such software. In fact, this can help you to know what taxes you have to pay or whether you accidentally made a transaction that you did not know was unethical or unlawful.